The Unproductive Wealth of Nations - The Case of Gold in India **NEW!!**

Equation

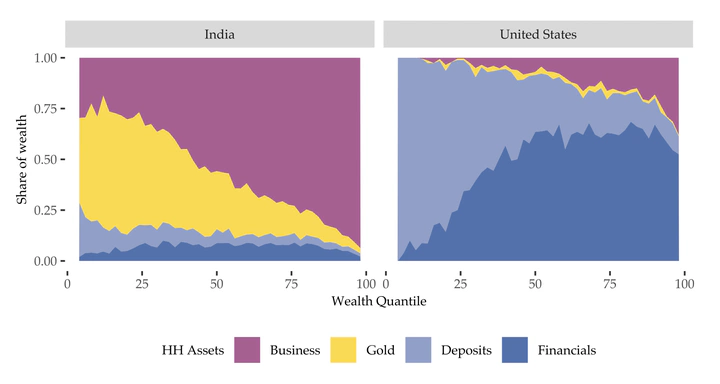

EquationIn advanced economies like the US, households channel much of their savings into financial assets that fund productive investment. In contrast, household balance sheets in developing countries are dominated by non-financial and often unproductive assets such as gold. This paper quantifies the development costs of unproductive savings, focusing on gold in India, where private gold holdings account for nearly one-fifth of aggregate assets. We develop a rich model of household saving and portfolio choice that incorporates main reasons for holding gold and which matches key macro and micro moments. The model implies sizable output losses from unproductive gold savings.